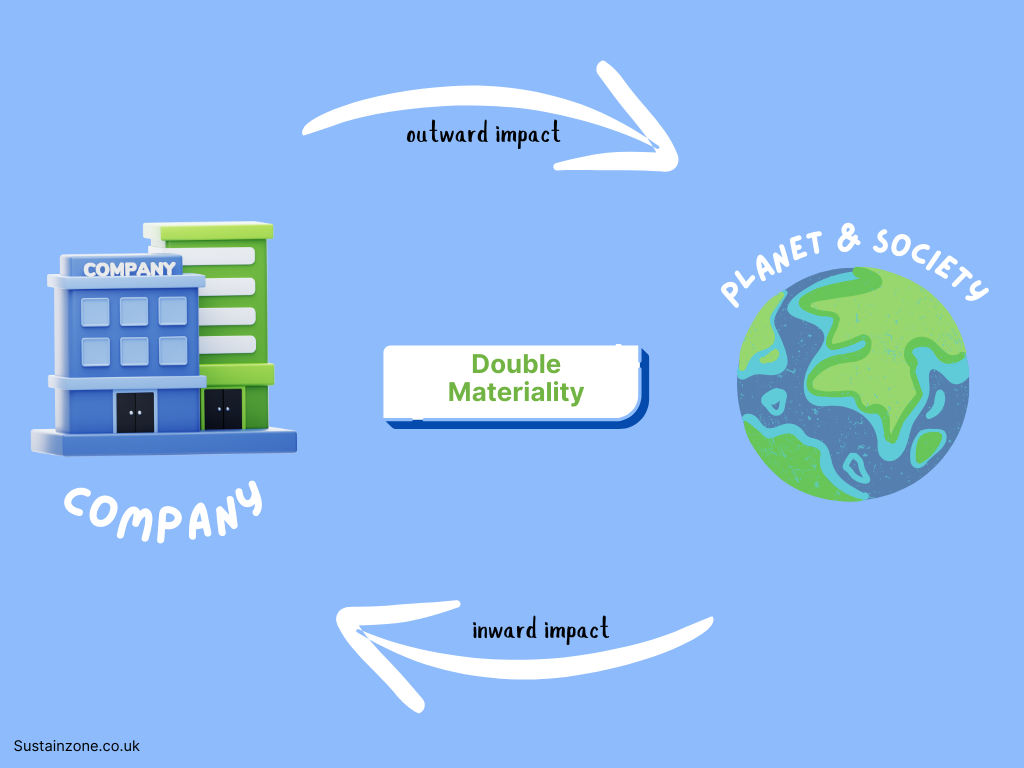

With the EU’s CSRD rollout, companies are revisiting sustainability policies for regulatory compliance. The concept of double materiality, a key element of the CSRD, is transforming ESG reporting. The concept expands, asserting that the organisation must evaluate its ESG effects concerning the financial risks and opportunities presented by sustainability issues.

Thus, understanding and interpreting the double materiality correctly is important not only for reporting purposes but also, more importantly, for compliance as well as for using it as a tool for creativity, trust, and value creation.

What Is Double Materiality?

A richer understanding of sustainability issues is achieved through the application of double materiality in reporting.

- Materiality of Impact (Internal Perspective)

This settles on how a company’s activities as well as its products and services affect the society and the environment.

For instance: a company may focus on measuring carbon emissions, supply chain labour practices, water usage, or deforestation.

- Financial Materiality (External Perspective)

This is the other side of the coin that looks at how a company performs financially in terms of sustainability, how this resilience enables the company to generate potential future earnings, and how external factors impact those earnings.

Why Double Materiality Matters for Businesses

The EU’s new Directive in Effect Report is a great regulatory move but there is a lot that can be gained from embedding double materiality beyond compliance.

ESG disclosures provide a level of credibility to investors, customers, and stakeholders, ultimately addressing the concern of greenwashing. This helps businesses take proactive steps to address ESG risks and opportunities, reducing potential disruptions.

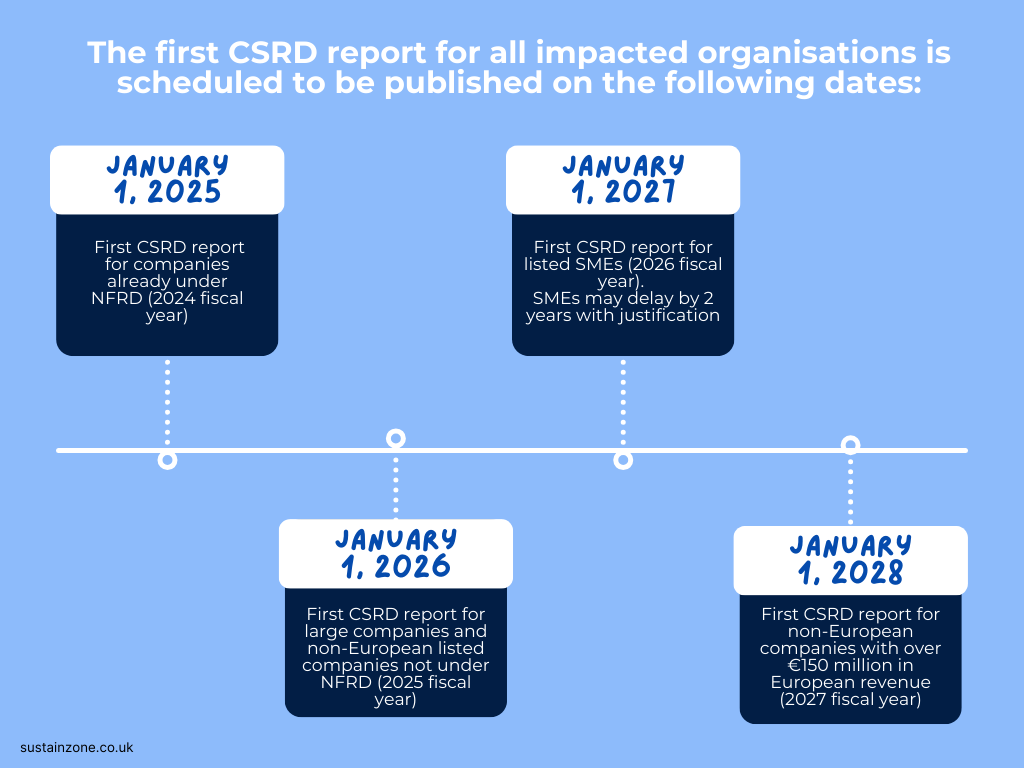

The CSRD standards help companies attract investors who prioritise ESG compliance. Starting in 2024 for large listed companies and extending to smaller companies in 2025, the CSRD requires businesses to perform double materiality assessments as part of their ESG reporting. Additionally, it is a mechanism through which the process improves operations and more importantly, introduces alternative and more sustainable business practices.

Of note, double materiality is fundamental to understanding the EU’s wider sustainability objectives within the framework of the Green Deal aiming at climate neutrality by the year 2050.

Challenges in Implementing Double Materiality

Despite its advantages, numerous organisations face challenges regarding the implementation of double materiality assessments. These include:

- Complacency:

If the EU institutions are willing to adopt a directive, they should construct a plan on the timelines.

- Minimum Verification Needed:

The ESRS scope and volume have to be monitored throughout the process, which implies substantial resources and also powers.

- Stakeholder Breakdown:

A failure to identify relevant players particularly communities and environmentalists means the results will be devoid of thorough interrogation.

- Insufficient Record Management:

Bad record management weakens audit preparedness and reduces the level of confidence.

- Static Constructs:

Treating the assessment of materiality as a once-off exercise makes it impossible for many organisations to keep pace with the changes in the law, as well as the changing expectations of society.

Best Practices for Effective Double Materiality Assessments

Overcoming such challenges could be achieved through the below strategies:

Start Early and Plan Strategically:

Unfortunately, advance preparation eliminates the risk of failing to conform. Once you are able to isolate Major Issues within your ESG reporting framework, get the same documented with the required milestone, responsibility, and deliverables so as ease future adoption of such procedures.

Invest in Resources and Expertise:

Internal reporting teams must be trained well or recruit teams that possess regulatory skills and people who are familiar with the companies ESG landscape and reporting requirements.

Engage Diverse Stakeholders:

Employees, customers, NGOs, local communities, as well as other pertinent surrounding environments should be able to provide input in the reporting and assessment process. Inclusion of quiet stakeholder influencing factors, such as ecosystems that are not suitable for addressing assessment reports, deepens the assessments.

Maintain Robust Documentation:

The company must keep almost every piece of document, processes, decisions and data to assist in audits as well as provide transparency.

Adopt A Repetitive Approach:

Because double materiality is constantly evolving, it can be considered a repeatable cycle that encompasses each year’s issued report. Thus, it’s relevance and accuracy could be guaranteed over time.

Making Double Materiality a Strategic Asset

The real power of double materiality is that it can help shape the actual strategies that can be put in place. Here’s how organisations can make the most out of assessments:

- Translate Insights into Action

Use assessment findings to prioritise initiatives that align with ESG goals and address identified risks.

Align these initiatives with broader corporate strategies for seamless integration.

- Enhance Communication and Reporting

Develop clear, visually engaging reports to communicate findings effectively to stakeholders.

Highlight the alignment of sustainability efforts with financial performance to appeal to investors.

- Partner with Auditors Early

Collaborate with auditors to ensure compliance with ESRS standards and improve the quality of disclosures.

- Adopt a Long-Term Perspective

Embed double materiality into a multi-year reporting strategy, keeping pace with regulatory changes and societal expectations.

The Future of Double Materiality

With sustainability reporting evolving over the years, double materiality is bound to be an even greater driver of corporate practices. As they embrace CSRD compliance, organisations have the potential to drive innovation, differentiate themselves in the marketplace, and foster a more sustainable future.

Double materiality is far more than yet another compliance checkbox — it is a fundamental change in how corporations address ESG risks and opportunities moving forward. By adopting such a framework, organisations can position themselves not just to achieve better compliance, but to also improve their reputation, strengthen stakeholder relationships, and catalyse long-term value creation.

Conclusion

The adoption of double materiality under the CSRD marks a pivotal moment for sustainability reporting. By embracing this dual perspective—evaluating both the impact of business operations on society and the environment, and the financial implications of external sustainability factors—organisations can align with regulatory requirements while unlocking significant strategic benefits.

Implementing double materiality assessments can be challenging, but businesses that tackle them proactively gain more than just compliance. By increasing transparency, building trust, and encouraging innovation, double materiality drives meaningful change. When included in a long-term, evolving reporting strategy, it helps businesses adopt sustainable practices that ensure resilience in a fast-changing world.

In the journey toward climate neutrality and broader ESG goals, double materiality is not just a reporting tool; it is a pathway to creating value, fostering trust, and ensuring a sustainable future for businesses and the planet.